Payment App Scams: Your Kids Are at Risk

Protect Your Kids Against Fraudsters

With the right financial education, children grow into adults who have the ability to save, budget, and avoid serious debt. They have the ability to live more fully, without being weighed down by financial stress.

That’s why we created Project ACCOUNTability, Pelican’s hub for all resources geared to teaching kids how to manage money. These tools are for parents and kids, including:

Pelican Youth Accounts

Absolutely! We do everything we can to support parents and their kids in understanding finances and providing the best-fit products for them.

- Make an appointment at one of our branches to start your child's financial journey and decide which accounts might be right for them.

- Our Financial Outreach team provides classroom financial education programs for Louisiana students at NO COST to the school!

- Pelican has also partnered with participating schools to provide School Pride Debit Cards that earn cash for the school!

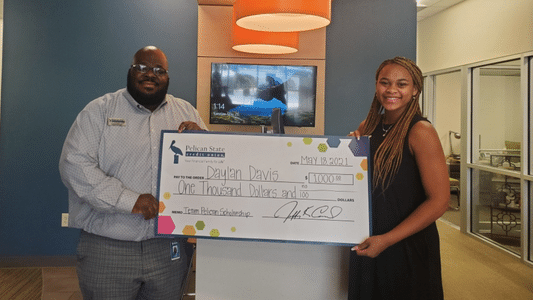

You bet! In fact, our Team Pelican Scholarship Award Program has awarded $129,500 in 15 years to high school graduates across Louisiana.

Keep an eye on the latest information for the scholarship award program located here.

We even have Team Pelican Youth Awards for kids! Check them out here.

Having a strong credit score is helpful in so many ways in the future of your child’s financial life. We suggest high school as a great time to start building your child’s credit. One of the best ways to do so is by adding them as an authorized user on your credit card while teaching them responsibility and education along the way.

No matter when you choose to help your child start building credit (if that’s a decision you make)—educating them on the topic early will pay off later.

- Pelican offers free resources including webinars, downloads, articles, videos, and more all geared to helping jumpstart kids’ financial education.

- Check out the youth section of the Pelican Blog for relevant articles for parents and kids.

- Parents can also check out the "For Kids" section of our website for more.