Pelican Pays for Good Grades!

Team Pelican members can get paid for each A on semester-end report cards¹.

Sign your kid up today to show them how Pelican Pays for their hard work!

Team Pelican Youth Savings1

- Earn 1.76% APY

- For kids 17 and under

- Get paid up to $5 per A on semester-end report cards

- No monthly service fee

- Learn how to save from an early age

- Automatically converts to a regular savings account on 18th birthday

Teen Checking & Debit Cards2

- For kids 13-17

- Pairs with a Team Pelican Youth Savings Account

- Choose from 7 different debit card colors

- Earn up to $10 per A on semester-end report cards¹

- Early Bird Direct Deposit³

- Real-time account monitoring and alerts

- Parent controls & limits

- Compatible with Apple, Google, and Samsung Pay

Team Pelican

- Earn 1.76% APY

- For ages 17 and under

- Dividends paid on entire balance; credited quarterly

- Get paid for good grades—earn up to $10 for highest attainable semester-end report card grade1

- No monthly service fee

- Eligible for a $1,000 scholarship award

- Open in conjunction with a Teen Checking account

- Get awarded $100 for exemplifying our Core Values

Teen Checking

It’s easy. Team Pelican members ages 13-17 can add any Pelican checking account and card to their Team Pelican Youth Savings account! When tied with a Team Pelican account, that checking account becomes a Teen Checking Account.

Is it Safe?

Absolutely. We have all the features you need to safely and securely manage your teen’s account:

- Real-time Account Monitoring – Get text alerts every time your teen’s card is used, then check the MyPelican app for even more transaction details.

- Purchase Limits – Money in the palm of your hand is tempting, especially for teens. The purchase limit on teen debit cards is set to $500/day, and the ATM limit is set to $105/day.

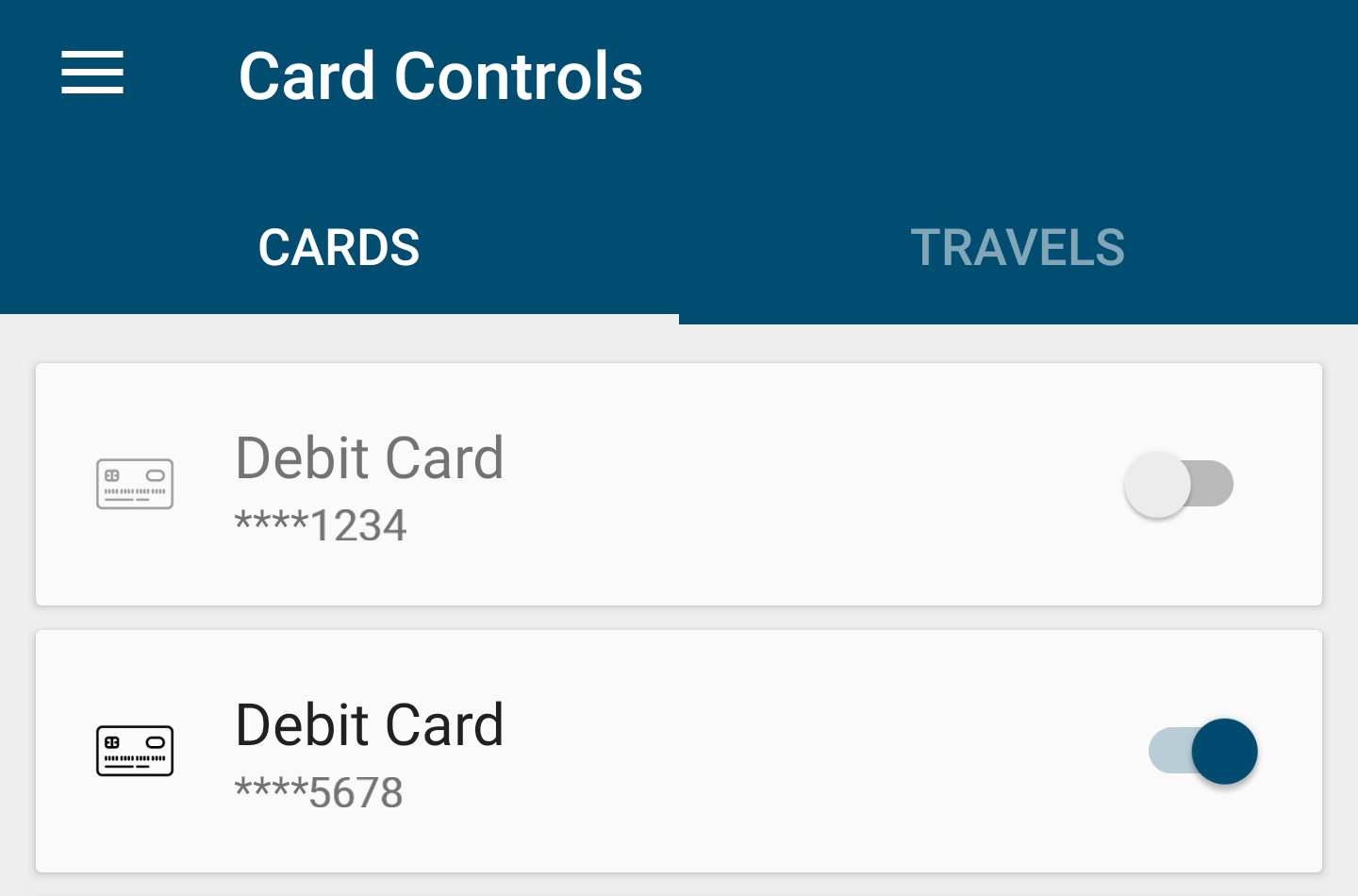

- Card Controls – Teens tend to lose things. If your teen loses their card, you can disable it with the tap of your finger in the MyPelican app. And when they find it in between the couch cushion, you can turn it right back on again.

We know letting go can be hard for parents! That’s why we’ve put together a list of tips and best practices for you and your teen so you can successfully manage the account together.

Some Fine Print:

- Parents must be listed as the joint account holder on the account and both names will be listed on the teen’s card.

- Overdraft Privilege will automatically be turned off and is not permitted on these cards/accounts; an overdraft link to a line of credit, credit card, or savings account is permitted at the parent/guardian’s request.

- Teens will be asked to provide a photo ID if they have one.

- The teen MUST sign the membership application in order to be issued a card.

Teen Account Management

These days, it’s important for teens to have access to money when they need it. Many financial institutions offer debit and savings cards for teens, including Pelican! Our Teen Checking works with our Team Pelican Youth Savings account and gives teens ages 13-17 their own secure debit or savings card.

These accounts are also a great opportunity to teach your teen about successful money management before they get to the “real world.” But it’s important to lay some ground rules and make sure you’re on the same page before you send them off with the plastic!

We’ve put together some guidelines that can help your teen manage any account, but also included tips specifically for Pelican's Teen Checking.

Make a Plan to Spend Wisely

- Discuss wants vs. needs with your teen.

- Decide on a weekly spending limit. Help your teen create a budget to remain under the limit.

- Review the account activity together each week and make adjustments to ensure the budget is being followed.

- Set a monthly savings goal of at least 10% of the teen’s earnings for emergencies and large purchases. If your teen has no financial obligations, encourage them to save at least 50% of their earnings.

- Remind your teen that the spending limit on minor cards is $500 a day and ATM withdrawals are limited to $105 a day.

- Review the account fees that your teen will be charged for using foreign (non-Pelican) ATMs along with the costs and penalties for overdrawing their account.

Track Spending

- Have your teen download the Pelican app on their phone for up-to-date account information. Visit MyPelican for more information and to download today.

- Work with your teen to keep a check register, either on paper or in an app, in order to track where their money is going and will go in the future.

- Keep receipts for at least two weeks to ensure purchases are charged correctly.

- Utilize our My Finances program to track spending, budget, and save for large purchases.

- Set up account balance notifications in MyPelican as a reminder that the teen is approaching their spending limits. These alerts should go to the parent and the teen by text and/or email.

Discuss Account Security

- Make sure your teen knows the importance of reporting a lost or stolen card to the credit union IMMEDIATELY. This can be done 24/7 by calling 1-800-351-4877 or logging into your MyPelican app.

- Remind your teen to never select a PIN that someone can easily figure out (such as a birthdate), always keep their PIN private, and never give their account password or information out.

- Discuss the dangers of online purchases and how to protect their account information from scammers. We recommend a parent being present every time an online purchase is made.

- Let your teen know that Pelican has 24/7 card monitoring, and that they may be contacted by email, text, and/or phone to confirm or deny that they made a purchase. It’s important that they only answer yes or no, and never accidentally give a phishing company pretending to call about fraud, locked cards, or other card related issues any card or personal information.

For more helpful tips for you and your family, visit our Tools and Resources page.

You can also set up a free financial wellness and money management session for your teen by contacting one of our Nationally Certified Credit Counselors at financialoutreach@pelicanstatecu.com or visiting pelicanstatecu.com/wellness.

*APY = Annual Percentage Yield. Rate is subject to change at any time.

1Pelican CU membership eligibility required. Adult 18 years old or older must be a joint account holder on child’s Team Pelican youth savings account. To open an account, the joint account owner must provide an unexpired government-issued ID for themselves and two forms of identification including a Social Security card, birth certificate, or unexpired government-issued ID for the minor. Highest attainable grade on the report card pertains to each individual semester-end report card’s grading scale, including A, S (Satisfactory), and (O) Outstanding. Maximum of $35 per semester-end report card for Team Pelican accounts ($5 per A) and $70 per semester if the student also has an active Pelican Teen Checking account ($10 per A). Copy of official semester-end report card required. Report card must list account holder’s name, school name, and date or year to qualify for rewards. Only the student’s most recent semester-end report card will be accepted. Report cards are accepted for either of the major semesters, such as May-end and December-end, or terms, such as spring or fall terms. December-end (or fall term) report cards can be cashed in until February 28 of the following year, and May-end (or spring term) report cards can be cashed in until July 31 of the same year.

²Pelican CU membership and Team Pelican Youth Savings account required to open a checking account for a minor. If you are not a Pelican member, you must be eligible to open a primary savings account with Pelican to become one. The deposit to open a primary savings account starts at a minimum of $15 ($10 to join + $5 minimum balance). A minimum deposit of $25 is required to open Kasasa Cash or Kasasa Cash Back account. Must be 13-17 years of age to qualify. The purchase limit on teen debit cards is set to $500/day, and the ATM limit is set to $105/day. Parent/guardian must be listed as the joint account holder on the account and both names will be listed on the teen’s card. Overdraft Privilege will automatically be turned off and is not permitted on these cards/accounts; an overdraft link to a line of credit, credit card, or savings account is permitted at the parent/guardian’s request. Teens will be asked to provide a photo ID if they have one. The teen MUST sign the membership application in order to be issued a card. Not everyone will qualify. Pelican reserves the right to limit the number of accounts allowed per member, joint or individually.

³Early Bird Direct Deposit is available for Pelican members with checking or savings accounts that set up direct deposit with their employer or other payroll provider to receive electronic deposits. Pelican will post ACH deposits once received from the Federal Reserve, which can be before the actual effective date. Early posting of deposits is not guaranteed and is dependent on the deposit being received before the effective date. Restrictions and limitations may apply.